Increasing tax filing accessibility for low-income residents

Our Client seeks to create an accessible, dependable, free tax preparation service to ensure low-income Dallas residents receive the returns they deserve

Background

The Earned Income Tax Credit and Child Tax Credit are two of the nation’s most effective anti-poverty programs. However, many working families in Dallas County do not take advantage of these programs, leaving approximately $474 million unclaimed each year. Our team was brought on to research and create a customer-oriented tax assistance model tailored to the needs of low-income taxpayers with the goal of putting money back into the pockets of Dallas residents.

Solution

A resource hub signposting people to available benefits positioned and marketed through trusted community partners

Lessons Learned

Technology is an enabler, not the complete solution.

The pilot of our proposed operational model took place in April 2024.

122

clients served in 21 days

$128,000

saved in tax prep and returns

100%

appointments in 30 mins or less

To tackle the unique challenges of this project, our team led a human-centered design approach. We conducted multiple rounds of user research and iteration to ensure the needs to Dallas residents were being met.

Discovery

Through both primary (community engagement, surveys, and user interviews) and secondary (competitive analysis and market analysis) research our team sought to explore:

- The key demographics, characteristics and needs of the target population

- The current paths/routes for filing taxes (e.g. paid preparers or support services)

- The main barriers faced when filing taxes

- The preferred method(s) and approach(es) to filing taxes

- Best practice outreach and engagement strategies and tactics for the target population

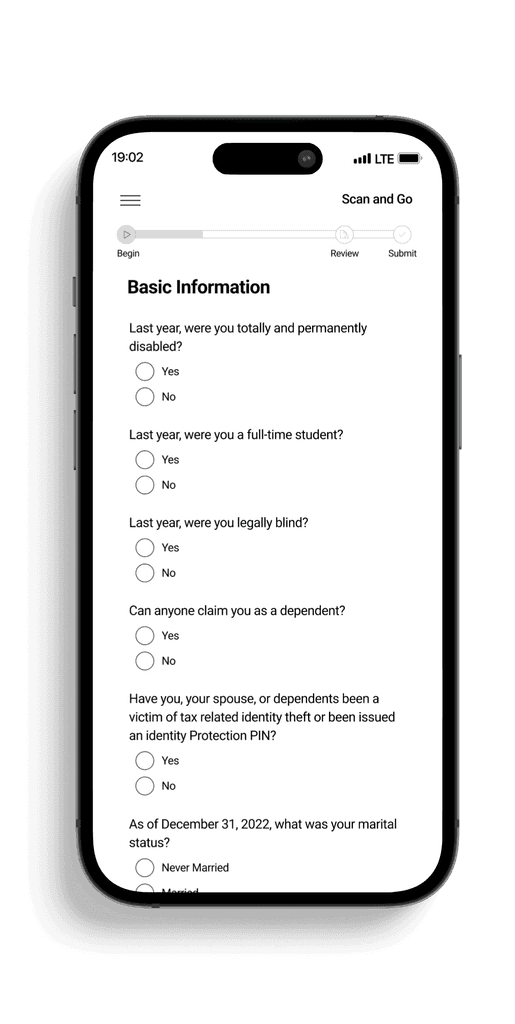

- Technology as an enabler, necessary product requirements

Design & Prototyping

Our team collaborated with developers to ensure feasibility throughout the design phase. We engaged prospective partners including local community organizations and larger governmental agencies to develop a pilot plan for implementation.

To this….

From this….

Testing & Iteration

Our proposed solution took on many forms. Our client was determined to create their own proprietary tax prep product. After testing and further consideration it was clear that for a pilot, a signposting tool leveraging existing tools in the marketplace and community partnerships was a short-term scalable model. We introduced the Beenfits Access Portal that could provide users with access to benefits far beyond taxes.

Implementation

We proposed a comprehensive go-to market strategy for a hybrid free tax prep model in Dallas a pilot that took place in the 2024 tax season.

We recommended a hybrid tax operating model that would provide residents both online and digital support to filing their taxes. The solution was piloted during the 2024. The solution achorded on the following design principles:

Ease

Deliver a convenient experience that feels easy and familiar to users

Choice

Deliver a service that meets different user preferences and needs (e.g., in-person vs virtual vs hybrid)

Empowerment

Deliver a service that supports and strengthens financial well-being and literacy

Confidence

Deliver a service clients trust and respect as professional